Search is the obvious candidate for clinic marketing ideas if you are working to grow a venture-backed healthcare tech startup.

In fact, it’s expensive yet so effective that it’s often worth overspending to get rapid feedback on your product. Especially, if it’s a newly built one that you are testing for product-market fit.

Even though they tend to be more expensive than Facebook ads, I’ve seen search ads beat them on overall ROI again and again by targeting the right keywords.

If your clinic only has the capacity to serve a small, limited number of patients every week then this is a simple way to get going. If you work at a venture-backed startup and focus on hockey-stick growth at all costs, then this is a necessary part of the digital acquisition portfolio.

Most clinics use marketing with the main purpose of acquiring more patients. There is no one “best” marketing channel for clinics to acquire patients but rather a portfolio of channels that each contribute a portion.

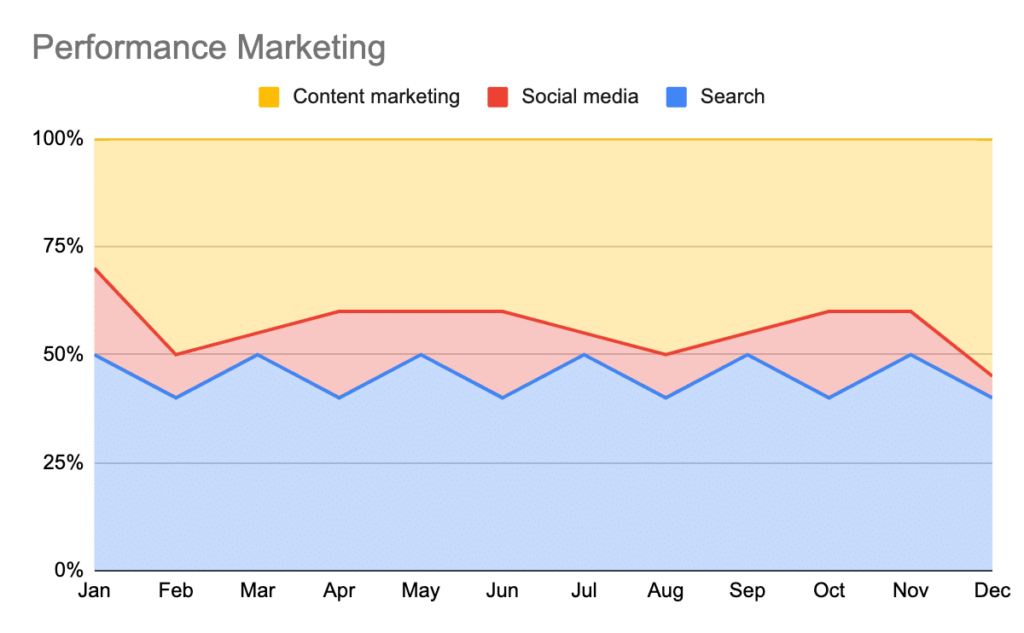

If we only look at digital performance marketing channels, a basic overview might look something like this:

The reason I’d usually suggest starting with search ads is that there often is some level of urgency when it comes to growing a venture-backed healthtech startup and I’ve found that overpaying for the initial portion of patients is often cheaper than what we’ll pay if the currency is time for learning at a slower pace.

Anyway, this article isn’t about search as that channel is well-known in our industry. It also isn’t a long list of meaningless clinic marketing ideas but an attempt at reverse-engineering which overall strategy and channels five successful venture-funded clinics have been using, so you can use it as inspiration and get in on the fun.

Since digital channels tend to be popular, the first thing I’d like to do is look at what some of the leading venture-backed clinics are doing out there as it’s often the most visible channels available.

5 leading venture-backed startups and their clinic marketing ideas to acquire patients

Let’s look at the following five venture-backed startups and see what we can find in the wild using only free tools.

- Forward

- Tia

- Carbon Health

- One Medical

- Brave Care

Forward

Forward Clinic raised $225 million in their Series D in 2021 and is a popular, futuristic-looking clinic.

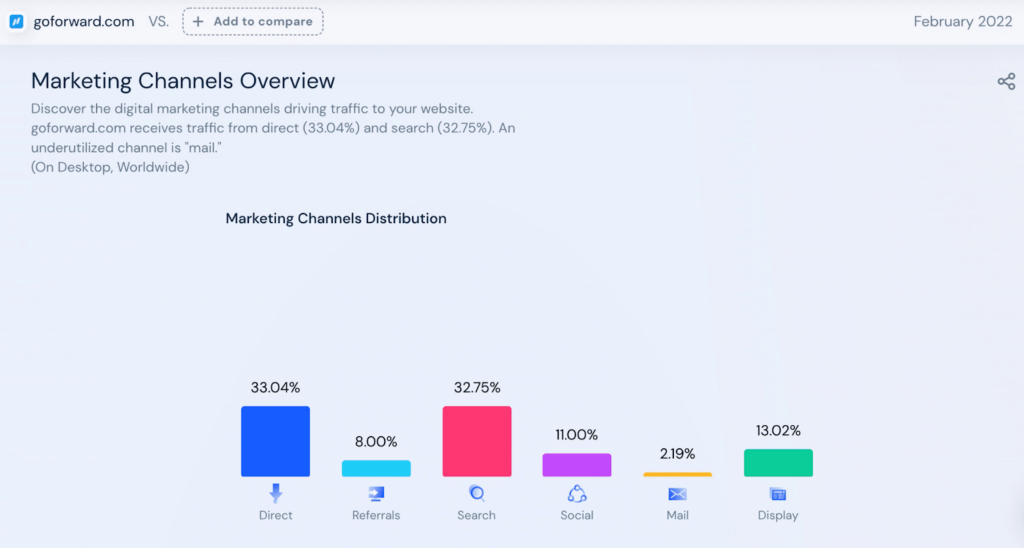

A good place to start is by looking at which channels drive interest in the business. We can get an overview from similarweb.com – it isn’t perfect but it is free and gives us a general sense of what’s going on.

This is the marketing channels overview.

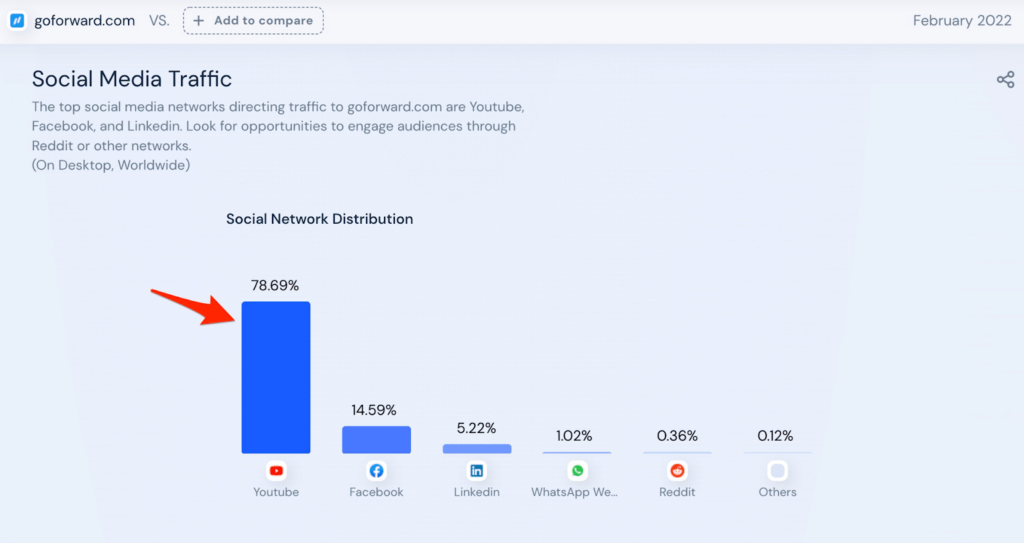

I’m not going to dive into the channels that contribute a smaller portion of the traffic as it tends to be a distraction. One channel might look like it provides a lot but is still a small portion overall, like we can see here with Youtube.

In this example, Youtube supposedly accounts for 79% of the social media traffic, which was only 11% overall. This might be worth looking into once we have the big wins down.

It appears as if the two biggest channels are search and direct traffic. Direct traffic can be a bitch to reverse-engineer but we can get a hint from the search keywords they show up for, so let’s dive deeper into those.

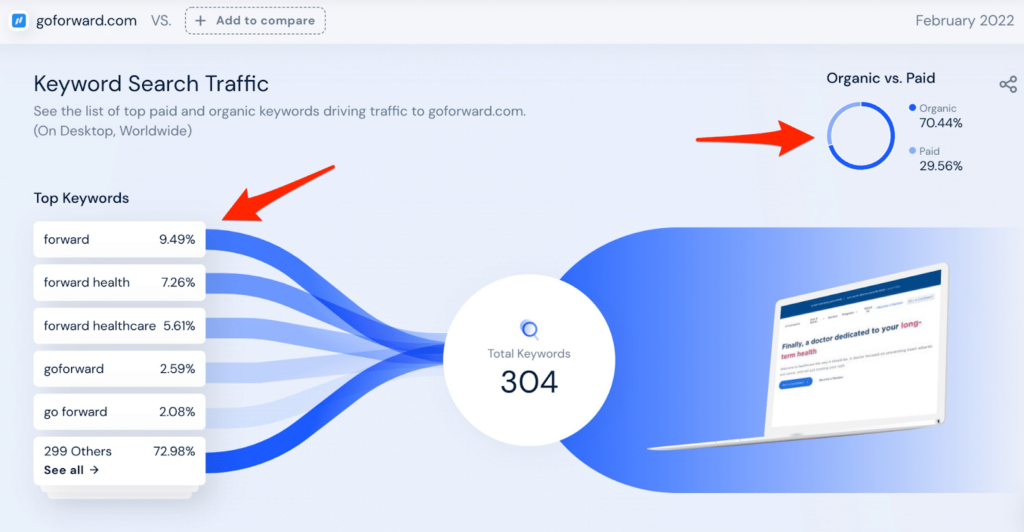

Similarweb gives us a limited overview here but we can see that a portion of the traffic is from paid ads, which may be contributing to the traffic coming from the display channel we saw earlier.

We can also see that the five most popular keywords are branded names, indicating that the people searching already knew what they were looking for and the search engines were merely the easiest way to navigate to Forward’s website logistically.

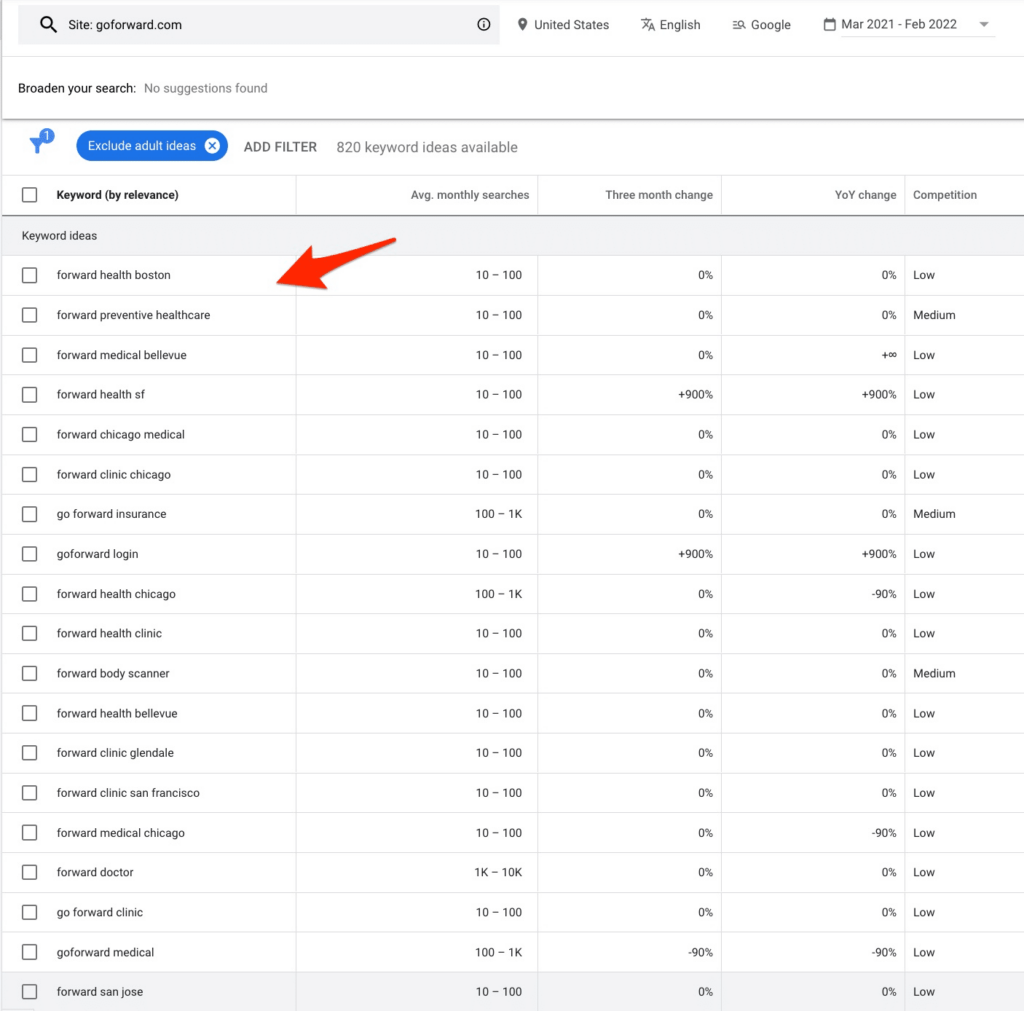

Using our old friend, the Google ads keyword planner, we can get a sense of the keywords they rank for. I apologize that the text in the screenshot is a bit small – I was attempting to get enough of them into one screenshot to get a sense of things. The pattern continues with more similar keywords and as we can see, it’s basically all branded traffic meaning that they likely learned about the brand from somewhere else before looking it up.

That likely explains why both search and direct traffic appear to be the highest contributing traffic channels but if we dive deeper, they likely weren’t.

It would appear as if search engines are not just a discovery tool but also a convenient navigational tool. A quick google search reveals this article suggesting that they have indeed been running ads across many platforms about a year ago.

That might explain the social media and display traffic we saw earlier that normally isn’t particularly effective within the industry.

Now that we have a general sense of what’s going on with the Forward clinic, let’s compare our findings with other venture-backed startup clinics.

Tia

Tia offers both virtual and in-person care specifically for Women, and they recently raised $100 million in their Series B.

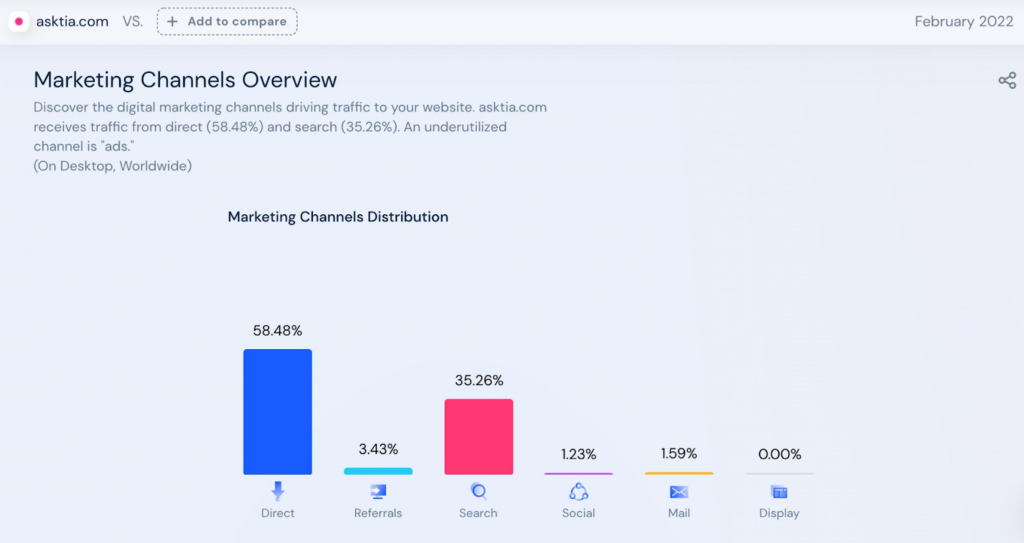

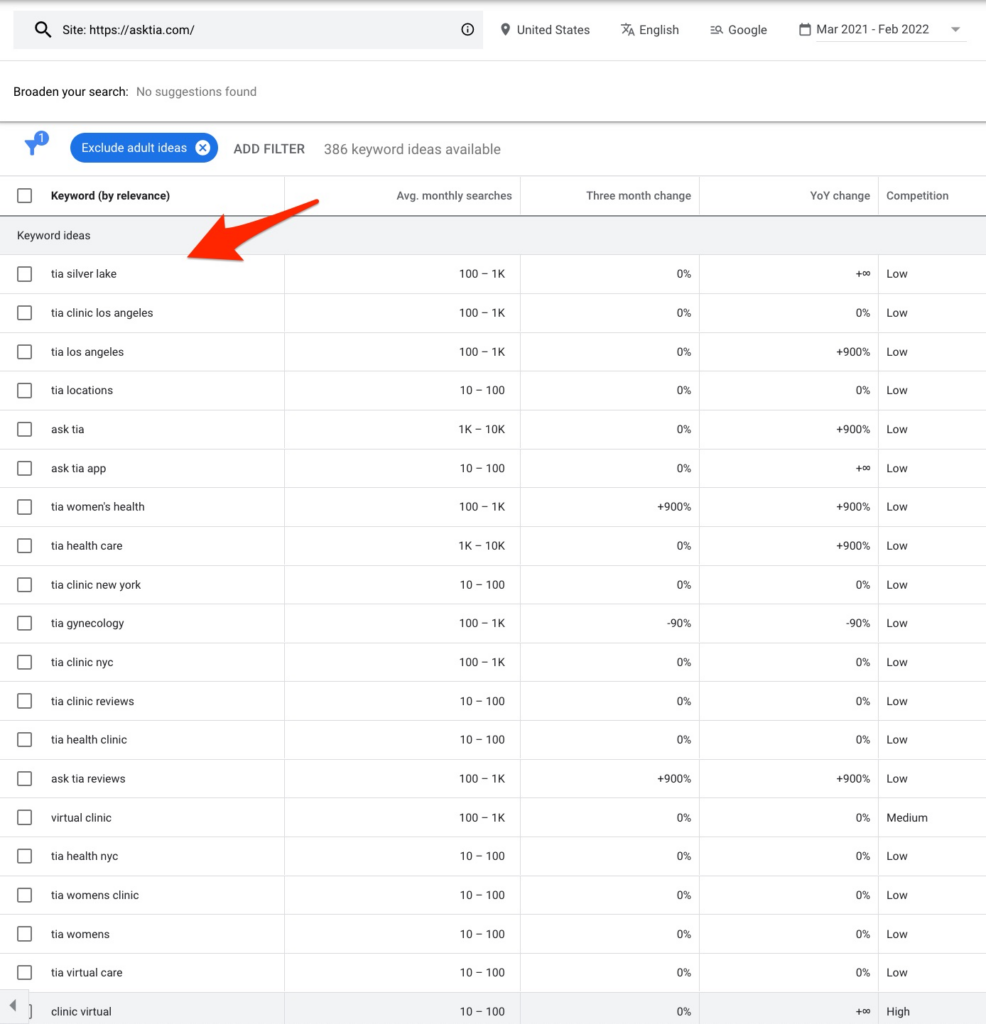

If we go through the same process with Tia, we’ll notice a similar pattern although with less digital advertising.

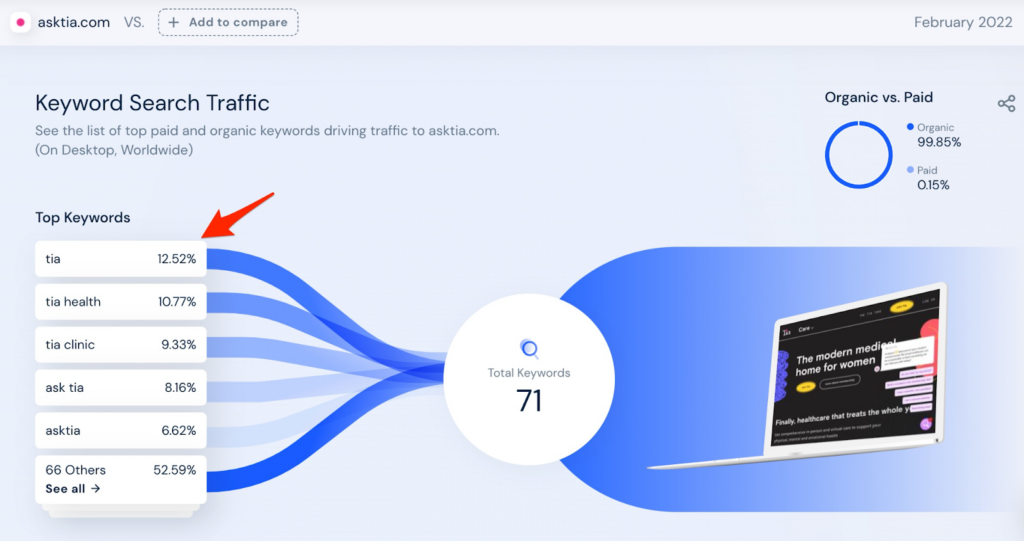

On the search side, we ser the same familiar branded keyword terms.

Although, as we dive deeper we begin to see a few non-branded terms (at the very bottom of the list in the screenshot below).

Interestingly, a google search suggests through this article that they started out using Instagram ads to acquire users before they could even monetize back in 2017.

Another article from agency partners suggests a large push with Facebook and Instagram ads back in 2020. Since we are using the free version of Similarweb for this exercise, the traffic is limited to recent months and that might be why it doesn’t show up in the traffic sources.

While this article isn’t about the specific creatives or ad campaigns themselves, a quick glance at Facebook’s ad library suggests that they are indeed running plenty of social ads these days too.

It goes to show that using free tools can only get you so far but it might also suggest that people don’t necessarily convert from the ads but rather that it sparks interest that leads to people searching for the brand to learn more. In the grand scheme of things, it doesn’t matter if they convert directly on the ads although it would be convenient for their performance marketers as it makes their jobs easier.

On a final note, the article above does state that 25% of the media was used on other channels like out of home, which usually refer to non-electronic offline ads in public such as those at bus stops.

Carbon Health

Carbon Health raised $350 million in 2021 and offers both virtual and in-person care.

For the first time in this exercise the search channel is suggested to be the one with the most traction. Based on what we found looking at Forward and Tia, I’d expect that we’ll see non-branded discovery keywords when we look at what the website is ranking for.

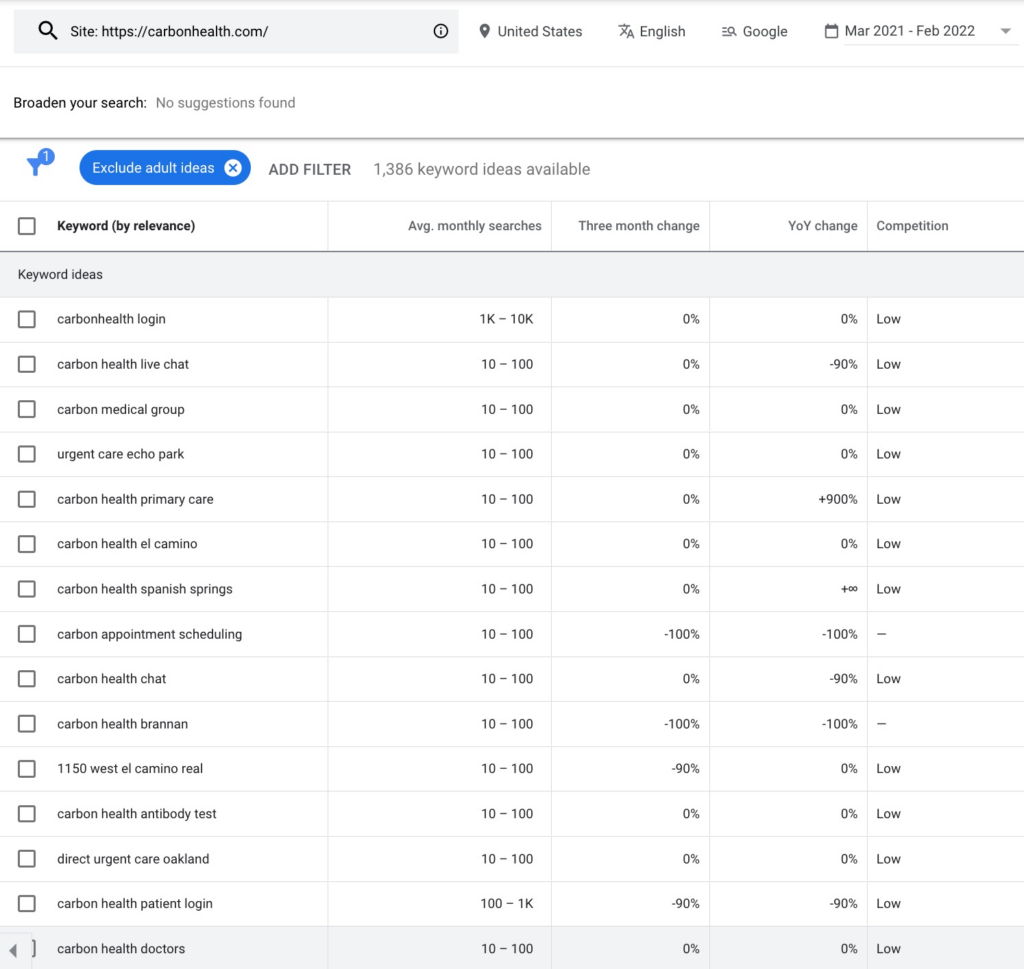

However, when we dive a little deeper into the keywords, it seems like all the top ones are also branded.

Google’s keyword planner suggests the same, so this could simply be an error or a misjudgement from the tool.

As we can see at the top in the screenshot, there are plenty more keywords they are ranking for, so it’s also worth it to dive deeper than just this short sample if you are looking for something more than just a general sense of what they are doing.

If you are looking for a deeper look at your competitors, you’ll probably like using a paid tool like SEMrush or Ahrefs to get a better sense of exactly which of the keywords and pages on the site drives the most traffic.

Looking for other hints, I found several articles suggesting an approach based on partnering with other clinics (here and here) and acquiring other tech startups in the space.

They even go as far as making this insightful argument against performance marketing during an interview in Forbes.

“Venture capitalists, in general, passionately hated anything that touches brick and mortar,” says Bali. “I was passionately opinionated that without physical locations, there’s no great healthcare.” That made fundraising a bit trickier, but the post-Covid landscape is starting to shift, especially as the cost of acquiring customers through digital advertising on Google and Facebook ads becomes increasingly expensive with no storefronts to drive organic traffic. “The downside of telemedicine is that your customer acquisition costs are actually a lot more than what we spend on clinics,” he says. In the Bay Area, 95% of Carbon patients are from word-of-mouth and walk-bys, while only 5% of new customers are from paid channels, says Bali.”

One Medical

One Medical IPO’d back in 2020 and also offers virtual and in-person care (noticing a pattern, are we?)

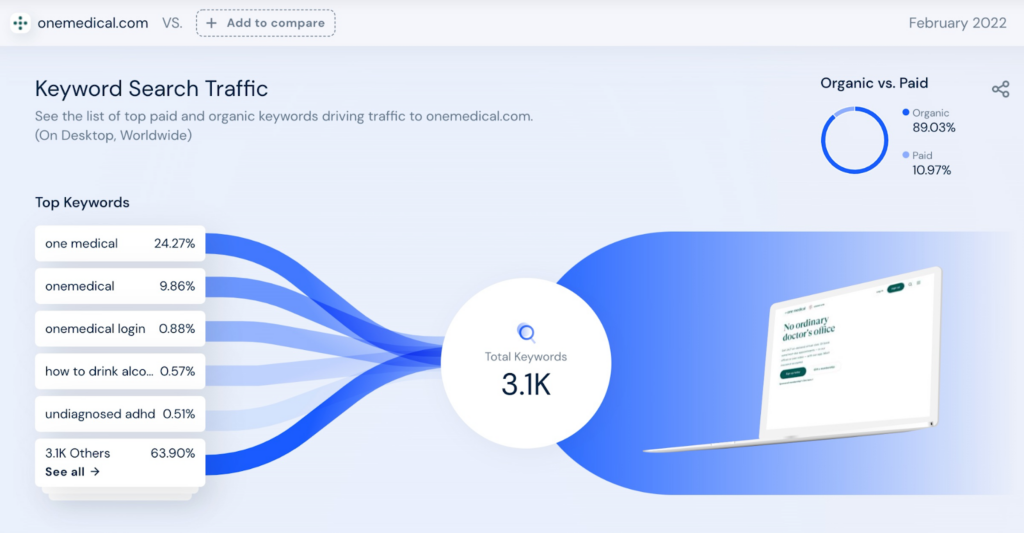

There are no surprises with the traffic split except here email has the most traction we’ve seen at all – not much more than the others, though.

It likely just means that they are emailing their customers or that they’ve done the odd email partnership with another brand. The portion is so small it isn’t worth it to look into – it’s also weird to compare email to the other sources in this overview since email is much further down the overall sales funnel than the others.

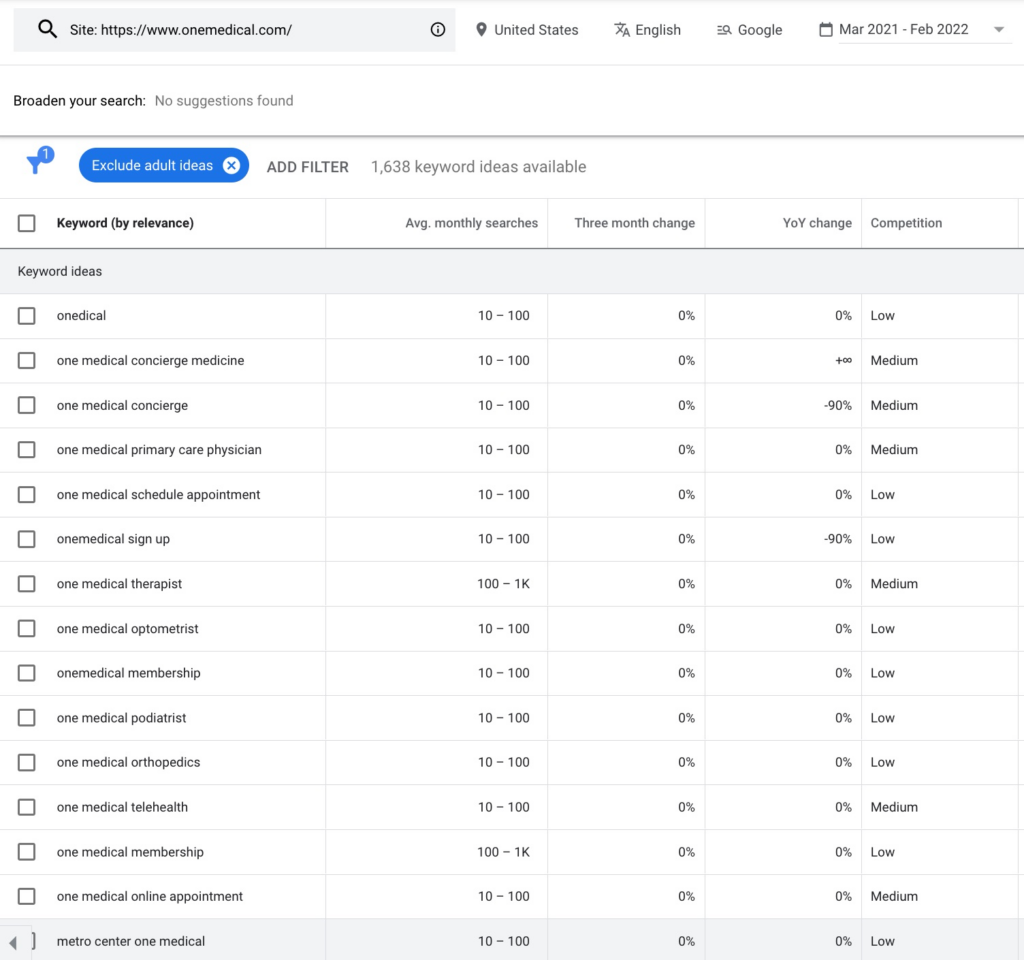

A quick glance at the keywords, and the pattern appears to be the same as with the other businesses we looked at – branded keywords for the most part.

As I was looking for interviews and other insights, word of mouth was mentioned: “Word of mouth is the number one vehicle for becoming a One Medical member.” by their CMO. He also pointed out that “One Medical has a sky-high Net Promoter (90+) because they can provide a level of care that is so far superior to the industry average.

One of their agency partners mentioned a focus on content strategy in a case study based on their patient journey analysis. That might be why SEO has some traction here although they don’t seem to be targeting discovery keywords.

They pointed out that they were specifically targeting two different audiences:

- “People who live or work near One Medical’s 60 locations, who might want convenient medical care.”

- “Businesses interested in great benefits for employees.”

This might indicate that the content strategy was focused on local SEO and digital traffic in the areas near their clinics.

Finally, let’s compare our findings with the last clinic: Brave Care.

Brave Care

Some brands are simply too small to show up in Similarweb’s engine, which may suggest that they are too small to be worth looking at overall or that they haven’t focused on digital channels, even though they recently raised $25 million in a Series B.

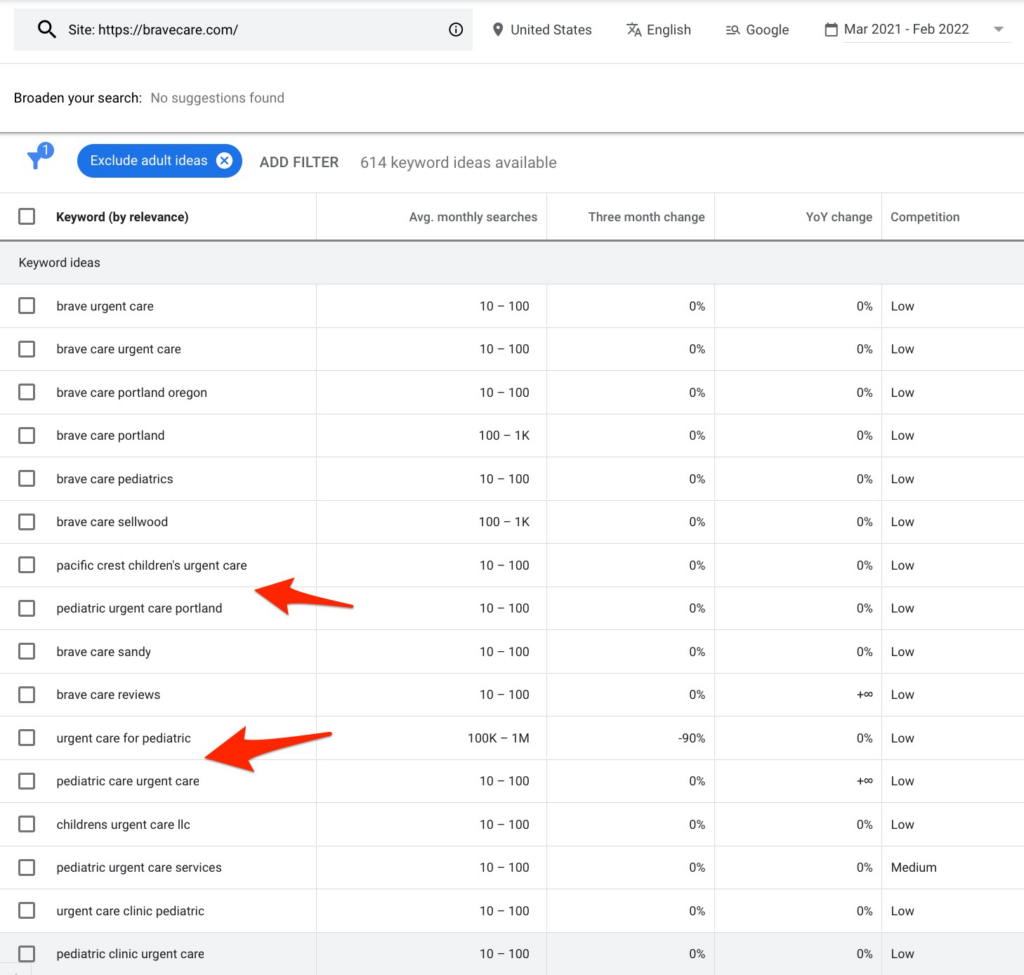

Looking at the keywords they attract interest from, we can see that there are a bunch of branded keywords but also some non-branded discovery-type keywords:

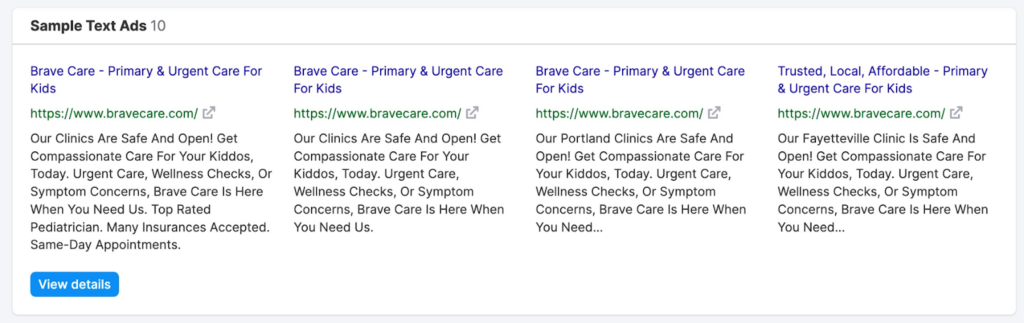

Other tools like SEMrush does suggest some use of paid search ads, and usually can offer the overview if you are willing to fork over the about $300/month it costs for this extra feature.

It seems likely that Brave Care is following a different strategy, focusing more on opening locations and capturing demand that way rather than driving it digitally which leads nicely into my next point.

Overall, we tend to see most straightforward conversions into sales from the search channel but these few examples might even suggest that the digital sales funnel just doesn’t follow the simple one we know from other industries in performance marketing, where it’s often as simple as ad → landing page → sale.

The patients might have some things they’d like to look up before committing or they might simply not be aware which exact type of physician they help need from — something I like to think a lot of clinics are underestimating.

Finally, I’d like to point out that there are rarely any secrets on digital channels. They are quite transparent and if you’d like to hide your most effective channels from competitors, one way to do it is to drive traffic using the most expected channels to mask the real high performing channels, which might not be digital at all.

It appears like the tech side of our industry still loves old school media when it’s time to spend the big bucks, for better or worse. In many cases, the search channel is the obvious choice but is also heavily used as a navigational tool after consumers have heard about the brand elsewhere.

This appears to leave a huge opportunity to actually use search as a discovery channel for the brands with smaller budgets as the cost per impression is often a lot less in the long run than with traditional media like TV or Out of Home (outdoor) ads. I’m sure one could make the argument that those channels might carry more weight than digital as they aren’t seen on the internet where barriers to seeing and clicking on them are fewer, and there are more distractions on the same screen at the same time.

The one big benefit digital channels have, though, is that many of the channels have a self-service option so you can spend a small budget to test out its effectiveness before dumping more cash.

In this very unscientific research, we can’t see where the conversions are happening in the business and the teams on the inside might not be able to either. I’ve noticed some signs that patients aren’t always following the classic (direct) path to conversion on digital channels that makes it so easy to track them.

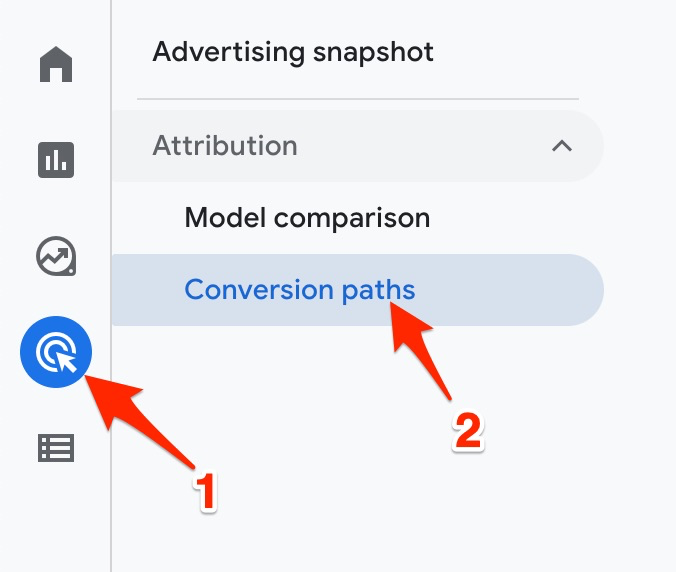

They might still be following it but dropping off to read reviews and come back later. We can’t be sure about how this works for competitors but we can find an overview for our own business in our Google Analytics as shown in the screenshot below.

It appears like conversions in the top 3 paths, in this example, found the brand via organic search and then either converted directly or came back to the site directly and converted at a later stage.

If you are looking to find the same report in Google Analytics 4, click these buttons in the left-side menu bar.

4 Clinic marketing ideas and notes on this

- Non-digital media seems to be the big one but could be done to please stakeholders or for other reasons than direct customer acquisition such as branding

- If I could pick any clinic marketing idea or channel just for customer acquisition performance and without thinking about political stakeholders, I’d pick digital search. Even if it might be expensive, the channel is well-known to drive performance in the industry

- A simple way to start is to drive organic long-term search traffic if you already have more than a thousand patients and are looking to scale whereas if you are testing the product-market fit, you’ll usually benefit more from a short term solution: spending money on ads to get product feedback fast.

- Another terrific option is partnerships as they require a network and might not feel as tangible as a direct to conversion ad campaign where everything is trackable